— ISSUE 31 —

COBRA-UPMC Employer OnLine Review

You are receiving this newsletter because you are a valued client of UPMC BMS COBRA administration. We aim to provide you with important information regarding recent errors identified in COBRA subgroup plans, which have resulted in premium billing discrepancies with UPMC Health Plan. Additionally, we would like to reiterate the UPMC Health Plan Employer OnLine (EOL) terminations and UPMC BMS COBRA notifications process.

We are experiencing situations where BMS COBRA client employers, brokers, or client representatives are mistakenly enrolling members into COBRA subgroups via UPMC Health Plan Employer OnLine. Specifically, COBRA subgroup plan codes are being selected for active employees instead of the appropriate active employee subgroup plan codes. While UPMC BMS has reporting mechanisms in place to identify these post-enrollment, we aim to be more proactive in preventing incorrect enrollments from occurring in the first place.

When adding or updating enrollments for active employees, please be mindful of the plan subgroup code you are selecting. We are seeing a higher occurrence with the UPMC dental and vision plans. However, similar errors have also been identified with the medical plans.

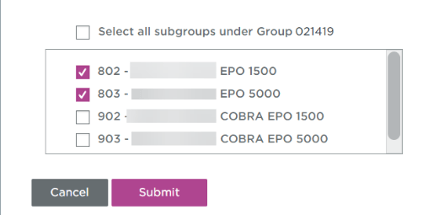

These enrollment errors are resulting in COBRA subgroup plans being in arrears with the Health Plan, as no COBRA premiums are being remitted. Please refer to the example below, which illustrates how the EOL indicates whether a plan subgroup is for active employees or COBRA.

Example:

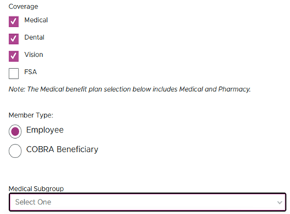

This month UPMC Health Plan will implement an enhancement to UPMC Health Plan Employer OnLine that will require the selection of a subgroup for either Employee Member Type or COBRA Beneficiary Member Type in all areas of EOL. Please see below example.

Example:

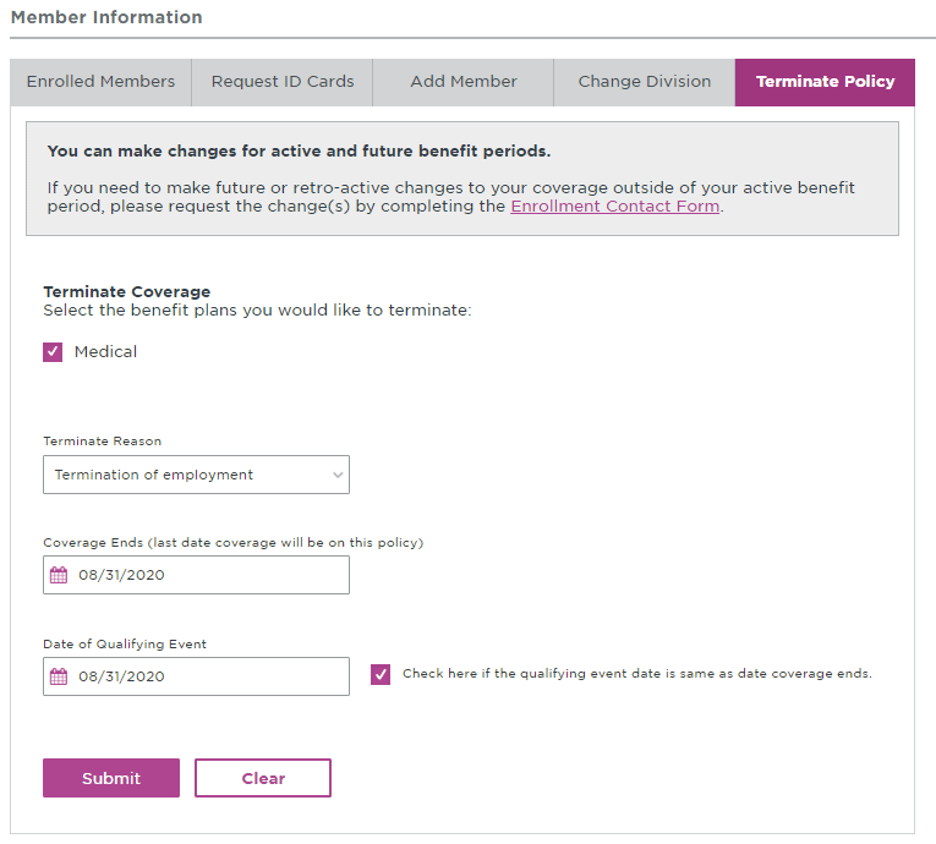

We would like to reinforce the COBRA notification process received through UPMC Health Plan Employer OnLine terminations and BMS COBRA administration. This process applies to clients who have all lines of coverage with UPMC Health Plan, utilize UPMC Health Plan Employer OnLine for coverage terminations, and have opted in to have their COBRA qualifying events automatically reported to our team via a daily termination report from the Health Plan.

If you have opted into the EOL COBRA functionality, you will need to access EOL to process only the employee termination. UPMC BMS will receive the employee termination on the daily termination report from the Health Plan and will generate a COBRA notice for the terminated employee. If the former employee elects COBRA and remits their initial payment, BMS will reinstate the COBRA coverage. Terminating an employee and automatically adding the member to a COBRA subgroup plan counteracts BMS COBRA administration and billing processes.

If you have any questions, please don't hesitate to reach out to your COBRA analyst. If you're unsure who your COBRA analyst is, feel free to email us at cobra@upmc.edu.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 30 —

COBRA Invoices

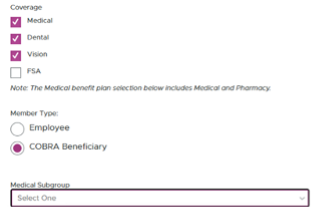

Updates have been made to the location of COBRA subgroup invoices. Effective immediately, the most recent and past COBRA invoices can be found in the Billing & Payment tab, by clicking on Historical Invoice Search.*

*Currently named Historic Invoice Search. This will be renamed to Historical and Benefit Management Services Invoices.

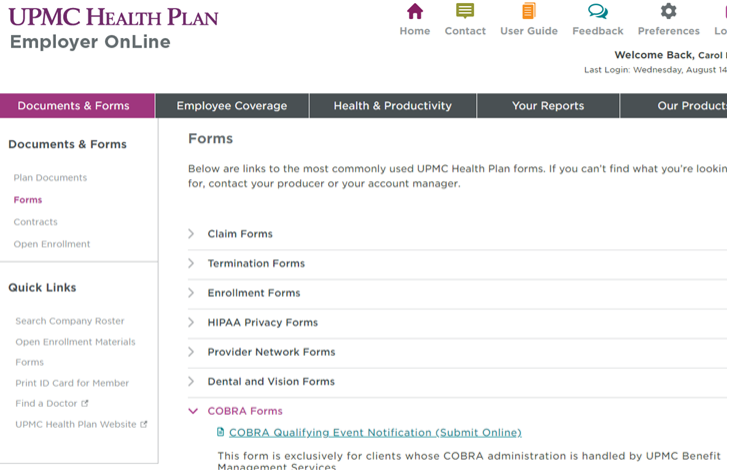

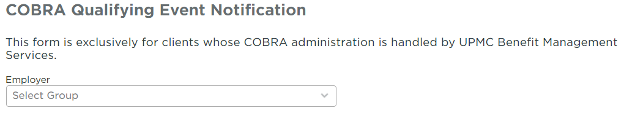

COBRA Qualifying Event Notification

We have a new Benefit Management Services feature on UPMC Health Plan’s Employer OnLine (EOL).

If you have not opted into the EOL COBRA notification process, there is now another secure option available. You can use the digital COBRA Qualifying Event form on EOL. This can be found in the Documents & Forms tab by selecting Forms.

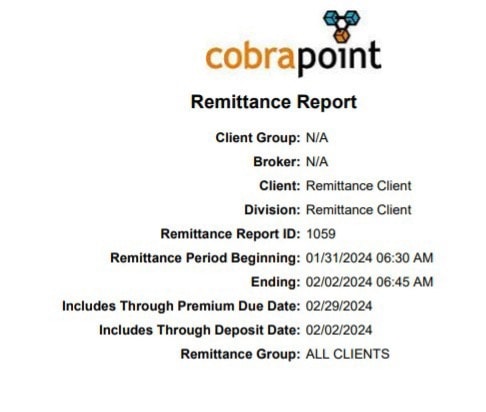

COBRA Remittance Report Reminder

As a reminder, Benefit Management Services has transitioned away from the monthly email delivery of COBRA remittance reports. Instead of monthly email delivery, we invite all our COBRA clients to leverage the COBRApoint employer portal for seamless access to their reports.

What does this mean for you?

COBRApoint offers a fortress of protection, ensuring that your data remains confidential and accessible only to authorized personnel. Data transmitted through the employer portal is encrypted, safeguarding it from interception during email transmission.

Remittance reports will be available for you to generate in the Reports Tab once we close out the billing month.

Due to COBRA mandates that allow a 30-day payment grace period, month-end closing typically occurs around the fifth of the month. Payments cover the prior month, not the current month for which the report is being generated.

Here is a link for the remittance report procedure, newsletter 29, as well as archived newsletters: https://www.upmchealthplan.com/bms/

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 29 —

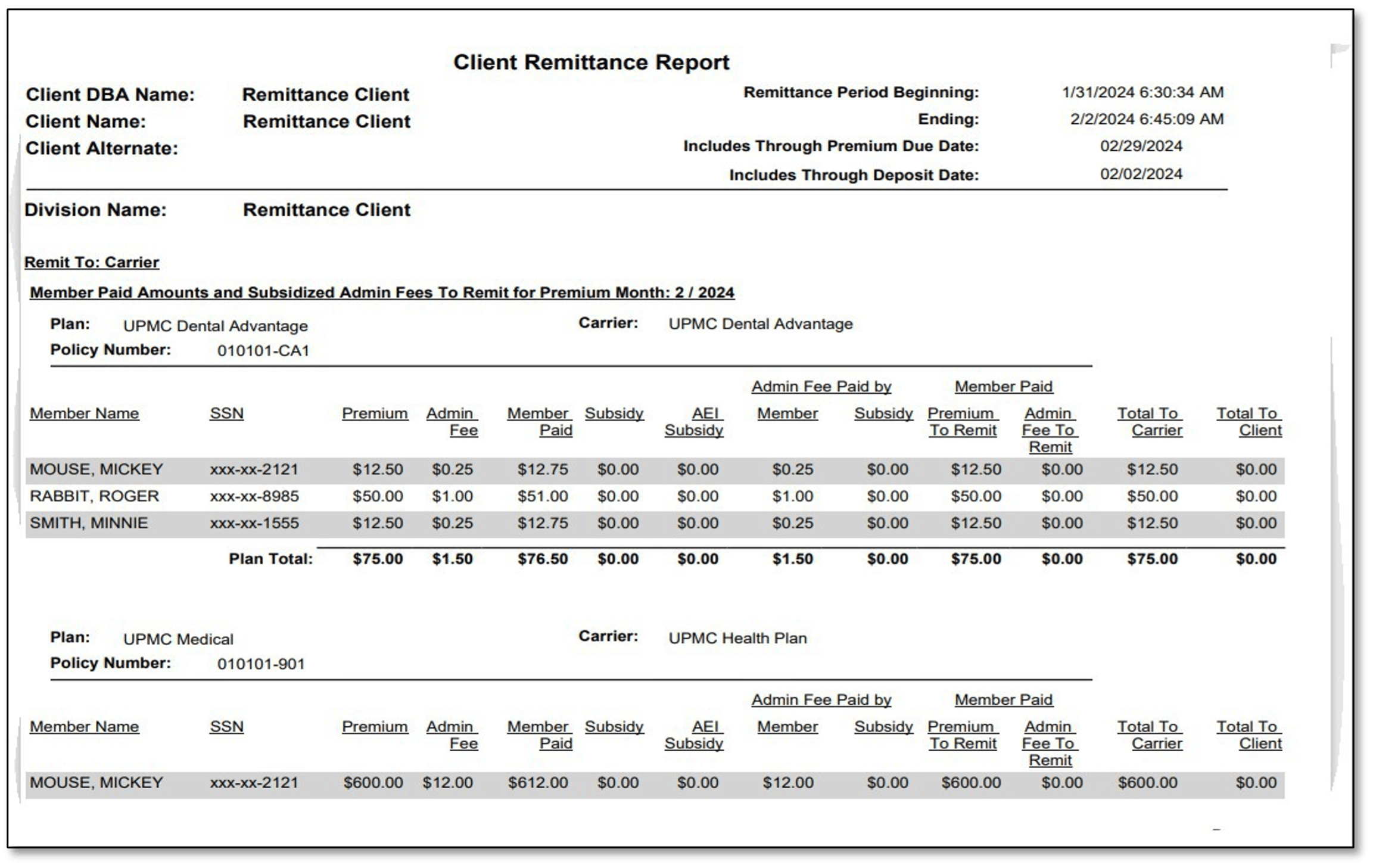

COBRA Advantage Client Monthly Remittance Report Procedure

What is the remittance report?

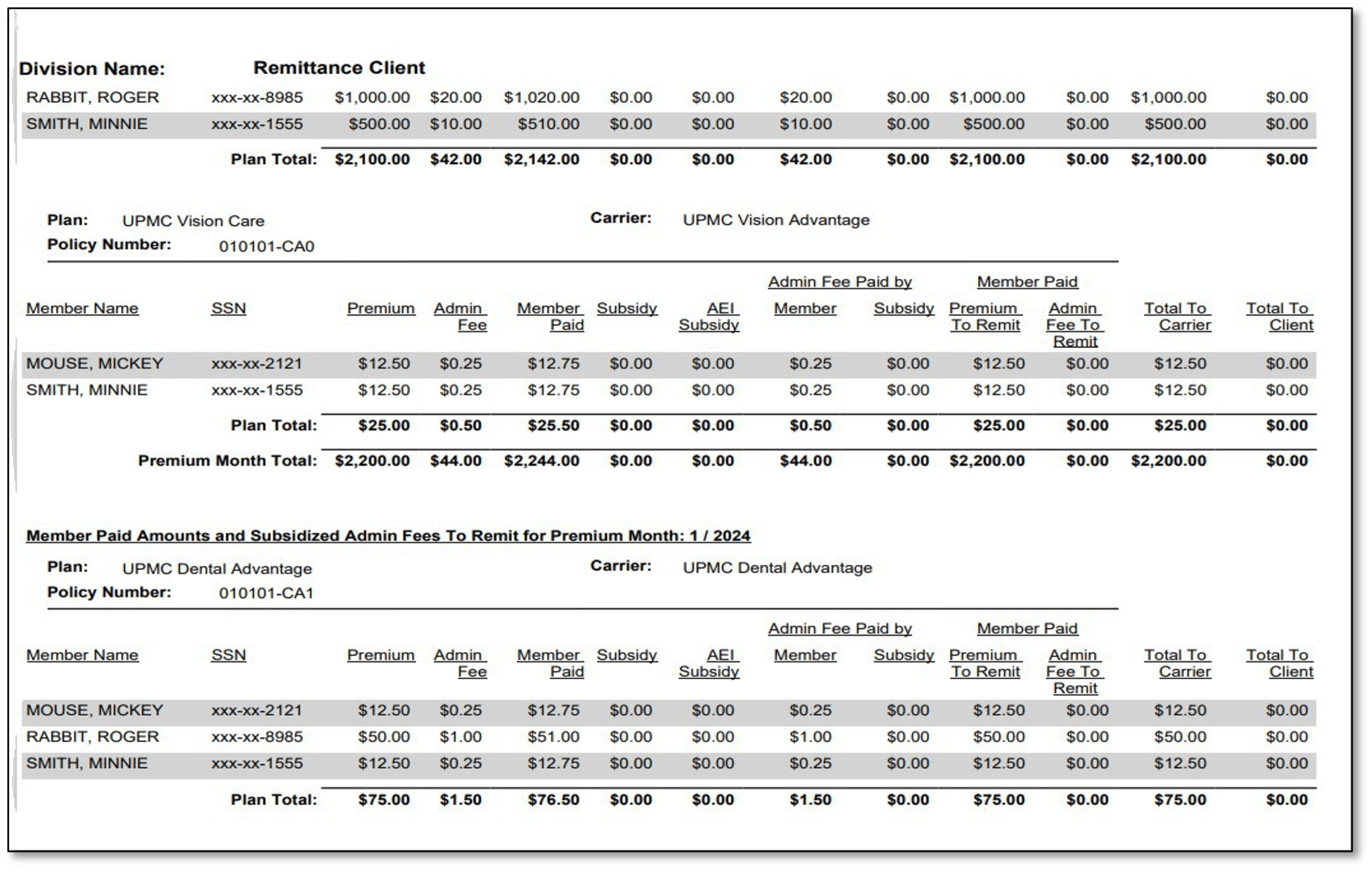

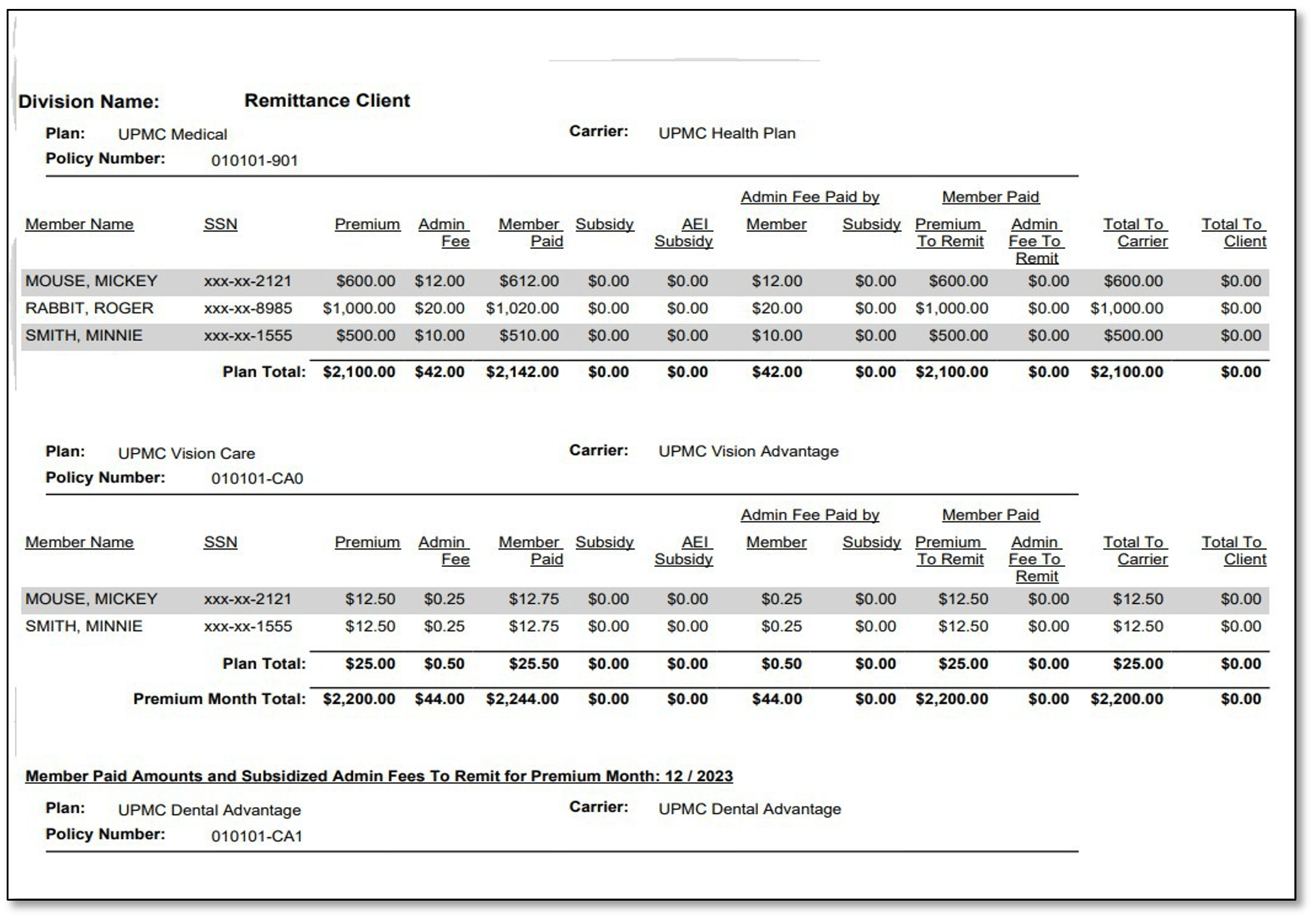

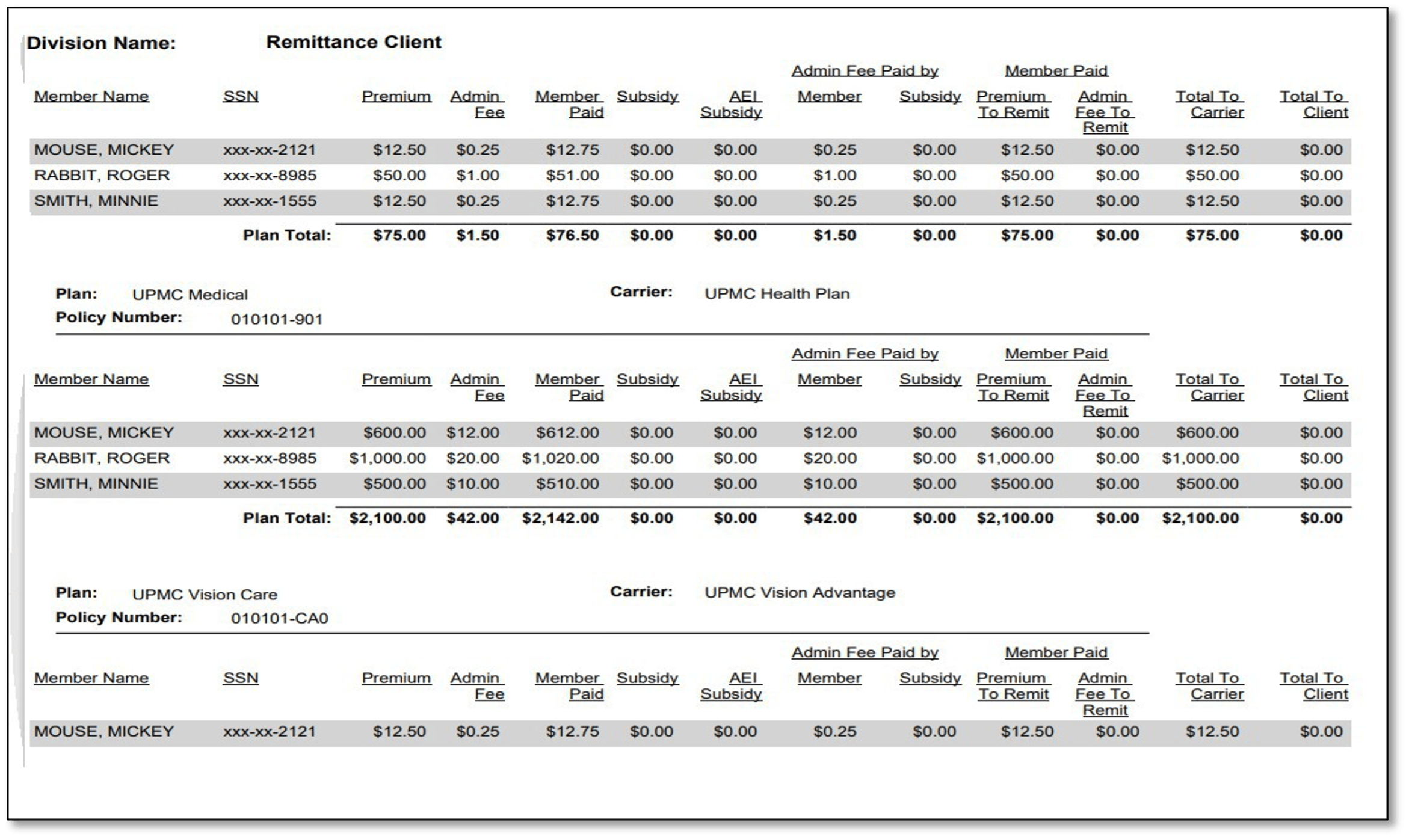

The remittance report contains a detailed summary of all payments applied to premium months that are due to either the client or carrier (minus bookable admin fees) through a specific date.

COBRA premium remittance reports will be available in the COBRAPoint employer portal by the 10th day of the month for the prior month’s COBRA premium payments.

How does this help me?

Having access to the remittance report will eliminate the need for your assigned COBRA analyst to email your COBRA remittance report to you when there are active participants. This self-service report feature eliminates the possibility of PHI data breaches. PHI stands for Protected Health Information and is defined as individually identifiable health information that is created, received, transmitted, or maintained by a HIPAA-covered entity or its business associates through which a member may be identified in any way.

How do I sign up?

If you currently log in to the COBRAPoint system, you are already signed up! If you have never registered in COBRAPoint and can no longer access your introductory email, please email cobra@upmc.edu or your assigned COBRA analyst.

How to access a remittance report from COBRAPoint:

- Select the Accounting Reports option from the Imports & Reports menu.

- Select the Remittance option from the Choose Report Type dropdown menu.

- The page contains a listing of all of the past posted remittance jobs in addition to the current unposted jobs. Click the Report link to run a detailed report that contains a breakdown of the remittance job by carrier. The page will refresh and display Report Settings.

- Use the dropdown menu to select a division, if applicable. Select ALL from the dropdown menu to select all divisions under the employer.

- Select the Mask SSN on Report option to hide members’ Social Security numbers on the report you are running. If this option is not selected, members’ complete Social Security numbers are printed on the report.

- Choose a Report Format option. This selection determines the output format of the report results.

- Adobe Reader Format (PDF–portable document file)–A document containing the text, fonts, and graphics it needs to display.

- Comma Separated Values Text File (CSV)–A document containing only numbers and text in plain-text form.

- Microsoft Access Database File (MDB)–A document formatted for an Access database.

- XML file (Extensible Markup Language)–A document containing textual data, usable over the Internet.

- If applicable, specify Email Addresses to notify when Report is complete by typing the desired email address(es) into the field. You can enter multiple addresses by separating each email address with a comma and no space. In addition to the notification, the email also contains a link to the job queue.

- Click the Run Report button to immediately send the report to the job queue. A confirmation will be displayed indicating that the report was successfully sent to the job queue.

- To view the results of the report, select the Job Queue option from the Imports & Reports menu or click the Job Queue link within the confirmation text.

- Your job should be the first entry listed. However, you can view the Job Type and Entered Date/Time columns for verification.

- When the job is done processing, a View link will be displayed within the Download Results column. Click this link to view or download the results of the report.

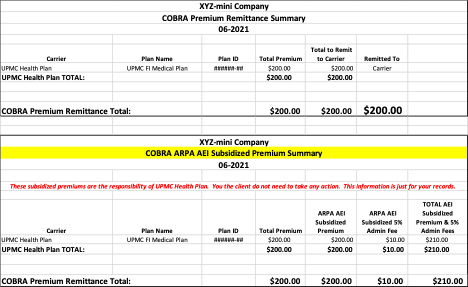

Remittance report sample:

If you have any questions, please contact us! cobra@upmc.edu

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 28 —

Did you know?

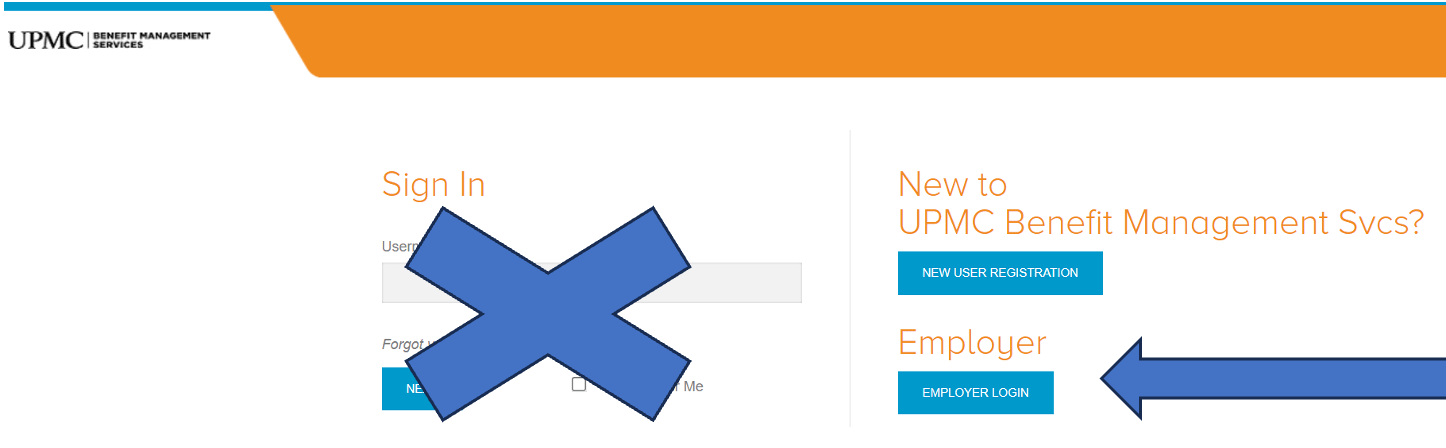

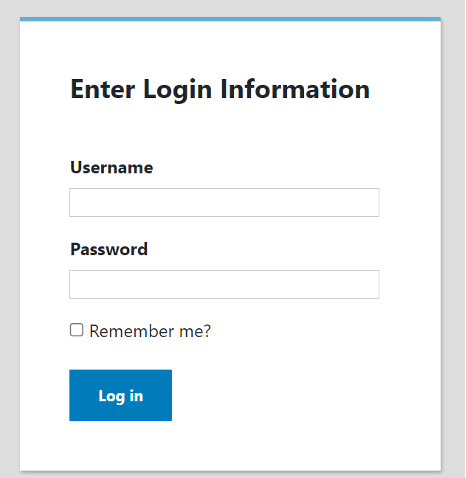

Have you noticed a new look to the COBRA employer login page?

The URL remains the same: cobra-retiree.upmc.com/, but there is a new look to login page.

This is the new look:

You will ignore the Sign In area and instead click on the blue Employer Login box. Then the usual login screen will be available:

Once logged in, you may add new COBRA Qualified Beneficiaries (QBs) and view current COBRA Qualified Beneficiaries (QBs) and correspondence that has been sent out. You can also run a variety of reports such as “Generated Letters Detail,” which would show you a listing of all the letters our COBRA system has generated for your COBRA members by date. This report is especially helpful because it allows you to monitor and verify that COBRA offers are being generated.

If you opted into our Buy Up services, you may generate General Rights notices for new employees.

We also have an employer COBRA manual that is very helpful and informative. Here is a link to the manual:

View the employer COBRA manual

Speaking of helpful information, you can access all our past newsletters by clicking on the dropdown in the Archive box:

You will find the Archive here: upmchealthplan.com/bms/.

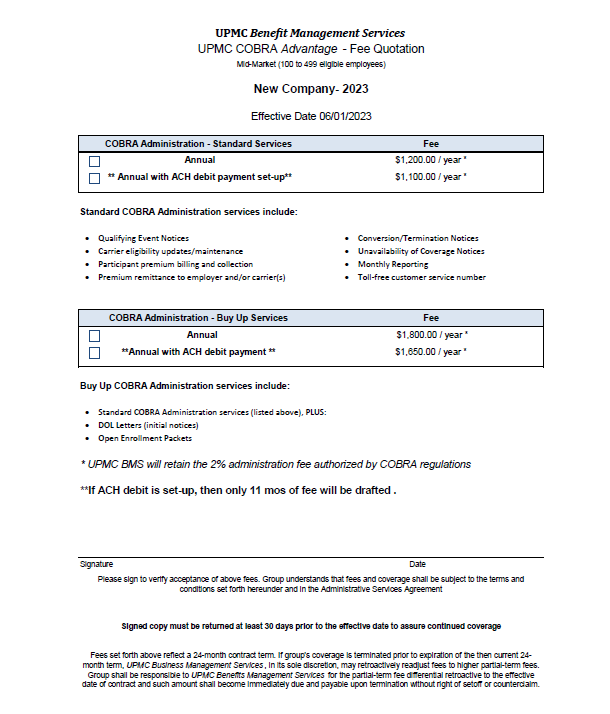

Did you know that the COBRA admin fee quote had a face-lift?

UPMC BMS generates a fee quote for our COBRA admin services upon initial set-up and then on a 24-month cadence. If you offer all UPMC Health Plan coverages, your COBRA administration fee is waived. If, however, you offer other carriers* for medical, dental, and vision, then there will be an administration fee for COBRA services.

Our full administration fee quotes have taken on a new look. We have discontinued the option to pay monthly or quarterly admin fees. Upon your company’s COBRA admin fee renewal, your options for admin payment will be limited to annual and if you opt to pay via ACH debit (for the entire year), then one month will be free.

* This is an incentive to offer all three lines of business with UPMC Health Plan!

See the updated fee quote example:

And finally, did you know that we are getting ready for Open Enrollment and if you have active COBRA members, they will need to be notified of any plan changes? If you are a UPMC Benefit Management Services (BMS) Buy-up client, we can help you with Open Enrollment. Please contact your dedicated COBRA analyst for information.

(Please know that rate change notices are sent out to all COBRA participants when the rates are updated in the COBRA system.)

If you have any questions, please contact your dedicated COBRA analyst. If you do not know who your dedicated COBRA analyst is, please email us at cobra@upmc.edu.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 27 —

News Flash

Updated June 10, 2023

After further research into the Department of Labor’s (DOL) guidance, UPMC Benefit Management Services (UPMC BMS) must modify the article in issue 27 that outlines dates associated with the end of the outbreak period.

Please see below–the modified timelines associated with the end of the COVID-19 Public Emergency and associated outbreak period pertaining to COBRA deadlines

Updated Timelines, revised based on DOL Guidance

| May 11, 2023 | End Date of National Emergency |

| July 10, 2023 | End of outbreak period (60 days after National Emergency End Date) |

| July 10, 2023 | Normal COBRA grace periods resume |

| Aug. 9, 2023 | Last Day for qualified beneficiaries to submit past-due premiums |

| Aug. 24, 2023 | Last Day for 45-Day qualified beneficiaries to submit initial premium payment |

On April 10,2023, President Biden signed a bill into law that officially ends the COVID-19 Public Health Emergency. The DOL issued further guidance on how the timing of this will affect COBRA timelines.

Even though the bill was signed on April 10, 2023, the DOL affirmed that the official end of the National Emergency was May 11, 2023. This means that the outbreak period will end on July 10, 2023 (60 days after the National Emergency ends).

Beginning July 10, 2023, all applicable COBRA deadlines will return to their normal time frames.

What this means for any qualified beneficiary who hasn’t made past due premium payments during the past yearlong grace period (until the end of the National Emergency). They now have until Aug. 9 to do so.

Also, any qualified beneficiary who made an election during the National Emergency, but did not pay their full premium, the 45-day grace period extends to Aug. 24.

UPMC BMS has again updated the Specific Rights Notice insert to reflect the end of the COVID-19 Public Health Emergency and wanted to share it with our clients:

View the Specific Rights Notice Insert

On April 10, 2023 President Biden signed a bill into law that officially ends the COVID-19 Public Health Emergency. Therefore, the “outbreak period” will end on June 9, 2023. Beginning June 10, 2023, all applicable COBRA deadlines will return to their normal time frames.

Since May 4, 2020, a rule was issued to extend certain deadlines occurring during the outbreak period under the Consolidated Omnibus Budget Reconciliation Act (COBRA). UPMC Benefit Management Services (UPMC BMS) modified the regulations time periods to allow for these extended time periods for both election and premium payment of which none can exceed one year.

Please know that the Department of Labor (DOL) is expected to issue further guidance. If any processes or communication must be modified as a result, UPMC BMS will communicate to our participants and clients in a timely manner.

UPMC BMS has updated the Specific Rights Notice insert to reflect the end of the COVID-19 Public Health Emergency and wanted to share it with our clients:

View the Specific Rights Notice Insert

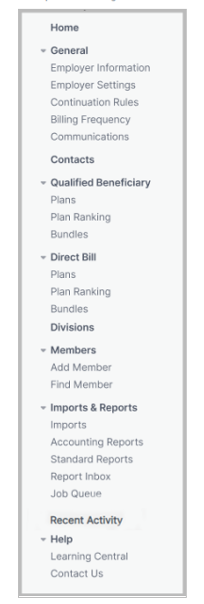

COBRA Employer Portal Update!

You may have noticed some changes on our COBRA Employer Portal. We’ve recently undergone an employer portal refresh to improve our user experience and to streamline functionality. This refresh features a redesigned left side navigation menu as well as improved page design for some screens.

New Menu:

Our Employer Portal User Guide has been updated for your convenience, and can be accessed via the link below:

If you have any questions, or would like a personalize walk-through of the updated site, feel free to contact your dedicated analyst or the UPMC BMS department at BenefitManagementServices@upmc.edu.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 26 —

HSA Tax Prep Checklist

- Check your W-2 for HSA payroll contributions

- Get your 5498-SA form for contributions (if you added funds)

- Get your 1099-SA form for distributions (if you added funds)

- Report contributions and distributions via Form 8899

- Carry information from completed Form 8889 to Form 1040

*The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

End-of-year tips for your employee’s HSAs

1. Make sure your W-2 form shows HSA payroll contributions.

Provided by your employer, your W-2 shows the wages you earned and any taxes withheld. It also shows pretax contributions made to your account by you and your employer through payroll deductions. (Remember, only contributions made through payroll will show up on your W-2. If you made any contributions outside of your payroll deductions, sometimes referred to as ad hoc contributions, they won’t be reflected and will need to be included when filing your taxes.)

2. Make sure you have access to your HSA tax forms.

A 1099-SA is the HSA tax form that reports distributions from your account. You'll need this form when filing your taxes.

On the other hand, a 5498-SA reports contributions. It’s a little different from your W-2 because it will show any contributions, not just those made through payroll deductions. This form is not a requirement when filing taxes.

The recipient instructions provided with each of these forms walk you through which boxes reflect which information as well as basic instructions on how to use the forms.

Employees can find the tax forms related to their HSA under the “Message Center” tab of their online account. These will be made available in Q1 of 2023.

3. Prepare to report distributions and contributions using Form 8889.

Form 8889 is used to report any distributions from and contributions to your health savings account. Think of this form as the place where the numbers from Forms 1099-SA and 5498-SA or W-2 come together. Any distribution amounts reflected on your Form 1099-SA need to be reported on this form, where you’ll also indicate which distributions were eligible for medical expenses. And any contributions made to your HSA should also be listed on this form. You’ll then carry that information over as deduction information on your Form 1040 (or the main tax form you fill out and file for your tax return).

4. Make any additional contributions.

Looking to make additional contributions to your HSA? The good news is that if you haven’t filed for the tax year yet and haven’t maxed out your annual contribution, you can still make additional contributions to your HSA to count toward the prior year. Normally, it’s recommended to do it by early April to be sure there’s enough time for any changes to process in your account and allow you to still complete and meet the tax return deadline.

If your employee wishes to make a prior year contribution between Jan. 1, 2023, and April 15, 2023, that you want to be allocated to the 2022 tax year, just be sure to notify us through your UPMC Consumer Advantage portal or with the HSA contribution form that the contribution was for 2022.

5. Employer corrections.

Contribution mistakes happen! But no worries, these can be corrected. If you find that you (as the employer) have missed any 2022 payroll or employer contributions, but it is already 2023, we can help make this correction for you. Typically, employer/payroll contributions must be made within the calendar year to which they are being applied, but the IRS does allow for clerical error corrections. If this is the case, please contact us for assistance. We will have you make the necessary contributions and then manually adjust them back to the 2022 tax year so they can show correctly on the employee’s end-of-year tax documents.

End-of-year tips for flexible spending accounts

- Check with your dedicated UPMC Benefit Management Services analyst for details regarding FSA deadlines for fund usage and filing claims.

- To check your employees’ balances, you can run account balance reports on the UPMC Consumer Advantage portal.

- Remind employees of eligible expenses that can be used for remaining FSA funds.

- This includes things such as out-of-pocket costs, copays, coinsurance, hospital visits, and prescription drugs.

- Employees also can apply their FSA funds to dental and vision expenses, including prescription frames.

- Finally, funds can be used for everyday items, such as bandages, sunscreen, and medications.

- The 2021 CARES Act allowed for deadline and carryover exceptions.

- With the 2023 plan renewal, the plan rules will return to the standard setup according to your most recent setup document in place.

- Any unused employee funds (after the grace period or rollover, if applicable) are forfeited to the employer.

- The forfeiture funds can be used toward offsetting administrative costs and annual premiums in the next FSA year, or funds must be equally distributed to employees.

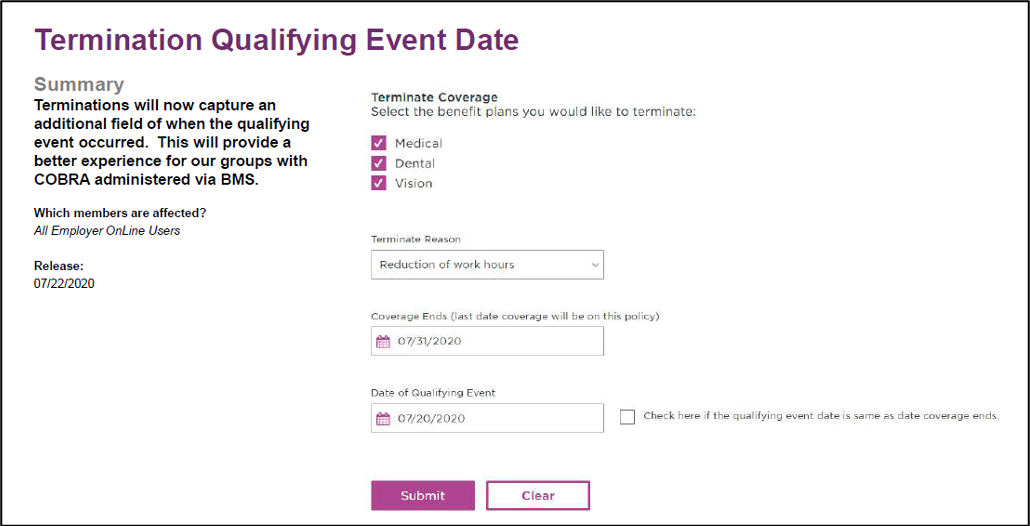

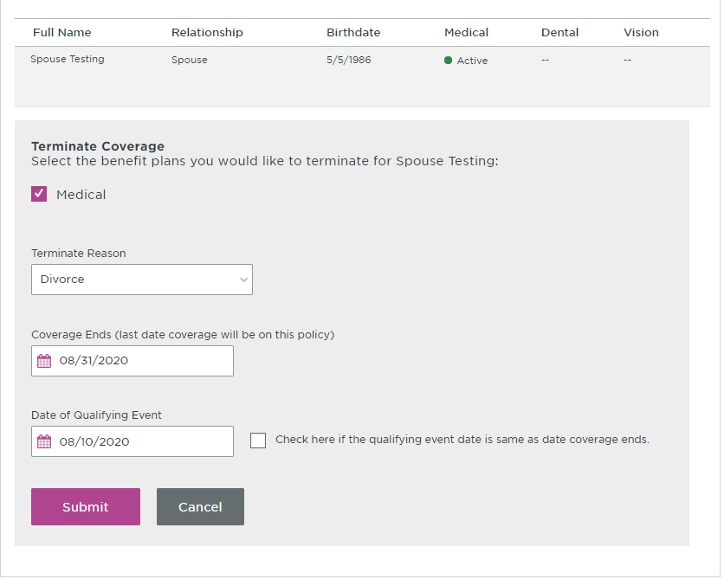

Automated qualifying event notifications for Employer OnLine users

When submitting a termination of coverage via the UPMC Employer OnLine (EOL) website, in addition to the termination reason and coverage end date, you can also enter the date of the qualifying event. This will allow EOL to communicate COBRA-qualifying events to the BMS COBRA team.

This also means no double work for you!

How does EOL work?

The EOL website generates an automated spreadsheet of all COBRA-qualifying events submitted the prior business day. This spreadsheet is delivered daily to the BMS COBRA team, who will then process the corresponding required COBRA election notices.

These termination reasons will trigger a COBRA election notice to be issued to the qualified beneficiary(ies):

- Termination of employment-voluntary

- Termination of employment-involuntary

- Reduction of work hours

- Medicare

- Death

- Divorce

- Ineligible child

- Retired

- Military service

A COBRA notice will not be issued for these termination reasons (these aren’t COBRA qualifying events):

- Moved out of service area

- Term COBRA coverage

- Other insurance

- Term by employer group request

A few other helpful hints to keep in mind:

- Reporting to BMS is transmitted only when a client keys the termination directly into EOL.

- Reporting to BMS cannot come from an outside source.

- For example, file feeds from a third party or membership termination form sent to Enrollment.

- If you have any questions, please contact your dedicated COBRA analyst. If you are unsure about who your dedicated COBRA analyst is, please email COBRA@upmc.edu.

Update on the COVID-19 public health emergency and how it affects COBRA:

The COVID-19 public health emergency has been extended through Jan. 11, 2023. This, in effect, continues the extension of certain time frames affecting a participant’s continuation of group health plan coverage under COBRA.

The following extensions are still in place, until the earlier of (a) one year from the date they were first eligible for relief or (b) 60 days after the declared end date of the COVID national emergency:

- COBRA election period:

- Under normal circumstances, a COBRA-qualified beneficiary (QB) has 60 days to elect COBRA.

- Under the extension, a COBRA QB will have up to a maximum period of one year to make an election of COBRA. The extension deadline will be determined on a per participant basis.

- COBRA premium payment period:

- Under normal circumstances, a COBRA QB has 45 days after submitting their COBRA election to remit their initial premium due. Subsequent premium payments are due on the first of the month of coverage, with a 30-day grace period.

- Under the extension, a COBRA QB will have up to a maximum period of one year to submit premium payment in full for any past due premiums. The extension deadline will be determined on a per participant basis.

— ISSUE 25 —

COBRA Administration

Understanding the rules governing extensions to COBRA coverage can be very important for you. The guidelines listed below come from the U.S. Department of Labor, Employee Benefits Security Administration (EBSA).

COBRA Administration Remittance Process Update:

Please know that beginning Oct. 1, 2022, all non-UPMC carrier premiums collected will be remitted back to the client/group. Please contact your dedicated COBRA analyst with questions. If you are not sure who your COBRA analyst is, please contact cobra@upmc.edu.

COBRA Administration—Disability Extensions and Second Qualifying Events

You may wonder if COBRA coverage can be extended beyond the 18-month COBRA time frame. It can, but only if either of these two conditions is met:

- One of the qualified beneficiaries is disabled.

- A second qualifying event takes place.

Disability Extensions

If any of the qualified beneficiaries in a family is disabled and meets the specified requirements, all qualified beneficiaries in that family are entitled to an 11-month extension of their continuation coverage (for a total maximum period of 29 months of continuation coverage).

The requirements are:

- The Social Security Administration (SSA) determines that the qualified beneficiary is disabled before the 60th day of continuation coverage.

- The disability continues during the rest of the initial 18-month period of continuation coverage.

In addition, the disabled qualified beneficiary (or someone on that person’s behalf) must also notify the COBRA plan administrator of the SSA determination.

What type of notice is sufficient?

A copy of the Social Security disability award letter must be provided to the COBRA plan administrator.

The plan can set a time limit for providing this notice, but it cannot be shorter than 60 days, starting from the latest of one of these dates:

- The date SSA issues the disability determination

- The date the qualifying event occurs

- The date the qualified beneficiary loses (or would lose) coverage under the plan as a result of the qualifying event.

- The date the qualified beneficiary is informed of the responsibility to notify the plan administrator and the process for doing so (the qualified beneficiary may be informed of this responsibility via the plan’s SPD or the COBRA general notice).

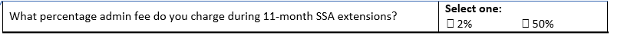

If the qualified beneficiary meets all requirements, then the 11-month extension will be approved. The plan can charge the qualified beneficiary an increased premium, up to 150 percent of the cost of coverage, during the 11-month disability extension. In such cases, the COBRA administrator would retain the standard 2 percent COBRA fee, and the additional 48 percent would be remitted back to the employer.

NOTE: You would have indicated whether your group intends to charge the 50 percent admin premium charge on your setup document under the company information section:

The right to the 11-month disability extension can be terminated if the Social Security Administration determines that the qualified beneficiary is no longer disabled.

Second Qualifying Events (Special Rule for Dependents)

If a qualified beneficiary receiving an 18-month maximum period of continuation coverage experiences a second qualifying event, the employee’s spouse and dependent children may be entitled to an additional 18-month extension of their coverage continuation (for a total of 36 months of continuation coverage, counted from the original first day of COBRA). A second qualifying event may be one of the following:

- Death of the covered employee.

- Divorce or legal separation of the covered employee and spouse.

- Medicare entitlement for the employee.

- Loss of dependent child status under the plan.

The following conditions must be met for a second event to extend a period of coverage:

- The initial qualifying event is the covered employee's termination or reduction of hours of employment, which calls for an 18-month period of continuation coverage.

- The second event that allows for a 36-month maximum coverage period occurs during the initial 18-month period of continuation coverage (or within the 29-month period of coverage if a disability extension applies).

- The second event would have caused a qualified beneficiary to lose coverage under the plan in the absence of the initial qualifying event.

- The individual was a qualified beneficiary in connection with the first qualifying event and is still a qualified beneficiary at the time of the second event.

- The individual meets any applicable COBRA notice requirement in connection with a second event, such as notifying the plan administrator of a divorce or a child ceasing to be a dependent under the plan within 60 days after the event.

If all conditions associated with a second qualifying event are met, the period of continuation coverage for the affected qualified beneficiary (or beneficiaries) is extended from 18 months (or 29 months) to 36 months.

Of course, both extensions are still subject to early termination of coverage continuation. The plan may terminate continuation coverage earlier than the end of the maximum period for any of the following reasons:

- Premiums are not paid in full on a timely basis.

- The employer ceases to maintain any group health plan.

- A qualified beneficiary begins coverage under another group health plan after electing continuation coverage.

- A qualified beneficiary becomes entitled to Medicare benefits after electing continuation coverage.

- A qualified beneficiary engages in fraud or other conduct that would justify terminating coverage of a similarly situated participant or beneficiary not receiving continuation coverage.

If continuation coverage is terminated early, the plan administrator must provide the qualified beneficiary with an early termination notice.

If you have any questions, our team of dedicated COBRA analysts will be more than happy to assist you. Feel free to contact your dedicated COBRA account analyst at any time or the COBRA department in general at COBRA@upmc.edu.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

Sources:

— ISSUE 24 —

Retirement Coverage Options

Health insurance is an important topic that needs to be taken into consideration when an employee decides to retire. Medicare eligibility normally begins at age 65.

Did you know that in some cases, employers may still be required to offer COBRA coverage to a Medicare-eligible qualified beneficiary (QB)?

If an employee is entitled to Medicare prior to his or her COBRA Qualifying Event, the employer must still offer COBRA when the employee becomes a QB. The QB would be eligible for 18 months of COBRA from the date coverage was lost (provided the Event Reason is Termination of Employment/Retirement or Reduction in Hours).

It is important to note that if the individual who is enrolled in Medicare also elects COBRA, Medicare pays primary, and the COBRA coverage becomes secondary.

On the reverse side, if Medicare entitlement occurs after a QB has already been offered and enrolled with COBRA, then the QB’s COBRA can be terminated early. The COBRA benefits should be terminated as of their Medicare effective date.

In this case, the individual’s Medicare entitlement may also be considered a second qualifying event for the member’s dependents, entitling them to an 18-month extension of their COBRA, for a total eligibility period of 36 months (counted from the original COBRA Begin Date). However, this can be a second qualifying event only if it would have caused the individual(s) to lose coverage under the plan in the absence of the first qualifying event.

What happens if an employee decides on early retirement before they are eligible for Medicare?

In these instances, the early retiree does have a few options to bridge this gap.

- COBRA is still offered for a term of 18 months, regardless of retirement date. This allows the early retiree to keep the same coverages they had before retirement without the worry about any coverage changes or network changes. The biggest downside to COBRA is losing the employer subsidy and being responsible for the full cost of coverage. That may not be affordable for some.

- After COBRA coverage has ended or if COBRA coverage is not offered, private insurance can be an option. A life event such as loss of group coverage, allows for a special enrollment period and the availability to elect plans on a state’s Marketplace (exchange). By visiting healthcare.gov, individuals can locate plans that are in-network for their area. Here the early retiree can also confirm eligibility for premium subsidies that can help lower the monthly premiums of these plans.

- Another option would be to apply for Medicaid. There is no Special Enrollment Period, and the plan is usually free or low cost for individuals who qualify financially.

Although not required, some employers may offer individuals who retire early a benefit package extending their subsidized employer coverage or offering credits to help offset the cost of outside health insurance. These options can vary greatly as they depend on the employer’s retirement program or agreement with the employee at the time of retirement.

Did you know that UPMC Benefit Management Services also handles retiree billing services for all retirees’ medical plans? Retiree billing provides coordination of enrollment, billing, premium remittance, and reconciliation services for retiree health and welfare plans. These services may be adapted to each client’s specific needs and requirements. Contact UPMC Benefit Management Services to learn more by emailing out team at benefitmanagementserivces@upmc.edu.

— ISSUE 23 —

Simplifying COBRA Administration

At UPMC Benefit Management Services, our goal is to take the burden of COBRA administration off your hands by offering simple, streamlined COBRA administration services. From issuing required COBRA notices, to premium collection, remittance, and eligibility reporting, we are equipped with the tools to handle all aspects of your COBRA administration efficiently from start to finish.

Automated Qualifying Event Notifications for UPMC Employer OnLine Users

For clients that have all lines of coverage with UPMC Health Plan and use the UPMC Employer OnLine website, your COBRA-qualifying events can be reported to our team automatically, with no additional steps required on your part.

How does it work?

When submitting a termination of coverage via Employer OnLine (EOL), you will be asked for a termination reason, qualifying event date, and coverage end date. This allows EOL to communicate COBRA-qualifying events to the BMS COBRA team. Any COBRA-qualifying events entered into EOL will be reported to the BMS COBRA team on a file the following business day. The BMS COBRA team will use this file to enter the information into our COBRAPoint system, and the corresponding COBRA notices will be generated the following business day.

How does this help me?

This feature eliminates the need for you to key your COBRA-qualifying events into two separate systems (EOL and COBRAPoint). You will no longer have to key the event a second time into COBRAPoint or complete a spreadsheet with the information to be sent to your dedicated analyst. Simply key the information into Employer OnLine and leave the rest to us!

Want to learn more?

Please take time to review our previously recorded workshop.

How do I sign up?

In order to be eligible for this service, you must have all lines of COBRA-eligible benefits with UPMC (i.e., medical, dental, vision, FSA), and you must also submit your qualifying events in Employer OnLine. If you have any questions or would like to sign up for this functionality, our team of dedicated COBRA analysts will be more than happy to assist you. Feel free to contact your dedicated account analyst at any time or the COBRA department in general at COBRA@upmc.edu.

FAQS:

When can I enter a termination into Employer OnLine?

You can enter a termination as soon as you are aware of the event. The member’s benefits will remain active up through the coverage end date you provide.

When will the COBRA notice be issued?

Once you enter the event into EOL, the information will be reported to the BMS COBRA team the following business day. We will then load the information into our COBRA system, and the corresponding COBRA notice will generate and be mailed the following business day.

Day 1: Client enters event into UPMC Employer OnLine

Day 2: BMS COBRA team receives event information on file and loads into COBRA system

Day 3: COBRA notice is generated and mailed to member

Which of the member’s benefits will be impacted by the termination submitted through EOL?

All benefits that the member is currently enrolled with (i.e., medical, dental, vision) will be terminated and included on the corresponding COBRA notice.

What happens next?

If the member elects COBRA coverage, the BMS COBRA team will bill the member directly for the monthly COBRA premium. We will also report the member’s COBRA eligibility to the enrollment team.

Do I need to submit payment for my UPMC COBRA premium invoices?

No. On a monthly basis, we will remit all COBRA premiums that we have collected from your COBRA members directly to the UPMC Health Plan premium billing department on your behalf.

Why do I still see COBRA premium invoices on my employer portal?

Due to system restraints, we do not have the ability to remove the COBRA premium invoices from your employer portal. Please rest assured that these invoices are for your reference only. You do not need to submit payment, as we are handling this for you.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 22 —

COBRA HRA premium calculation

An employer-funded health reimbursement arrangement (HRA) qualifies as a group health plan under COBRA. Therefore, you the employer are required to offer the HRA as part of the COBRA election notice package you offer to your eligible COBRA-qualified beneficiaries.

As the employer, you are entitled to charge a separate premium for the HRA COBRA benefit in addition to the premium for the medical COBRA benefit. Calculating the HRA COBRA premium can be confusing. We cannot establish this premium for you, but we can guide you on how to calculate it.

You can use either of two methods to determine the HRA COBRA premium: the past cost method or the reasonable actuarial determination.

1. Past cost method

The past cost method looks at the total cost of the HRA based on past utilization rates. For example, let’s say that employees have a $1,200 HRA plan ($100 employer contribution per month), but over the plan’s lifetime only 50% of the total benefits have been claimed and paid. In this instance, you would calculate the annual COBRA rate as follows:

$1,200 x 50% = $600

(Annual HRA Amount X Utilization Rate = Annual Rate)

In this example, the monthly premium for the HRA benefit would be $50 ($600/12). You (or your TPA) may also add 2% to the premium for COBRA administration fees, in which case the monthly rate would be $51.

2. Actuarial determination method

You can use the past cost method only if you have past costs, so it won’t work for a brand new HRA. In this case, use the actuarial determination method. You can engage a licensed actuary to use their data and resources to make a reasonable estimate of the cost of providing HRA coverage and use a formula to figure the monthly premium. For example, let’s say you estimate that, on average, employees who participate in the HRA will spend 50% of the available HRA dollars. You provide an annual $1,000 HRA contribution. You would calculate your premium like this:

- $1,000 X 50% = $500

- $500/12 (months) = $41.66

- You (or your TPA) may add 2% to the premium for COBRA admin fees.

Final tips

- You must calculate the HRA COBRA premiums each year before the 12-month determination period (usually at the beginning of the plan year for the HRA or when rates change for the underlying insured plan).

- You cannot charge different HRA COBRA premiums to different beneficiaries. The premium must be the same for everyone, except for differences in reimbursement maximums (e.g., single vs. family coverage).

- The method for calculating COBRA rates for an HRA is ultimately up to you. Your COBRA administrator cannot establish this rate for you.

As always, please reach out to your dedicated BMS analyst with any questions related to this and other COBRA administration topics.

— ISSUE 21 —

COBRA

The ARPA COBRA premium subsidy ended Sept. 30, 2021. We sent letters to COBRA members receiving ARPA subsidy benefits notifying them that the Period of Premium Assistance expired. We also included COBRA premium payment coupons that start with the next premium month due.

Please note: Because of COBRA grace periods, our COBRA remittances always run a month behind the current billing for your UPMCBMS active groups. Regarding the ARPA subsidy, that means you may still receive ARPA premium subsidy invoices from UPMCBMS through the end of this year.1 This situation will occur if you add new assistance-eligible members.2

Contact your dedicated COBRA analyst with any questions about your COBRA subsidy members.

Open Enrollment

What You Need to Know

Remember, COBRA-qualified beneficiaries have the same rights as active employees. During Open Enrollment, employees can change their benefits and add or remove dependents. Qualified COBRA beneficiaries can do the same.

If you offer an Open Enrollment period to active employees, you must do the same for COBRA participants. If you have the Buy Up COBRA option, Open Enrollment services for COBRA members are part of your COBRA administration package. Contact your dedicated COBRA analyst for more information.

1May receive subsidiary invoice in 2022, depending upon your billing cycle.

2Specific to any COBRA offer requests, with retroactive effective date within ARPA timeframe.

— ISSUE 20b —

The dust around the 2021 American Rescue Plan (ARP) has finally begun to settle, and second-chance COBRA offers have been mailed to assistance-eligible individuals (AEIs)! UPMC Benefit Management Services (BMS) has been sending out updated COBRA offers with language that reflects ARP regulations for qualifying events through Sept. 2021.

We hope your COBRA participants have gotten the information they needed and the burden of these new regulations hasn’t fallen on you and your team.

Because you are a mini-COBRA client, your AEI subsidized premiums are paid by your insurer per the ARP’s terms. BMS is committed to reporting your subsidized premiums accurately to ensure your records are correct. As such, we will provide monthly premium remittance reports for your AEIs.

With that in mind, we want to go over the COBRA premium subsidy afforded to you by the ARP and how it will be reported to you. Below is an example premium remittance report.

In the example – the premium reported is for an AEI’s coverage. The Summary page indicates in “red” that this will be subsidized by the insurer (in this case it is UPMC Health Plan.)

For information about the mini-COBRA designation, please review the terms below.

Mini-COBRA terms:

- Group size: 2-19 employees on a typical business day during the preceding year

- Qualified beneficiaries (QBs):

- Spouses (If the group allows domestic partners, they will be offered COBRA)

- Dependent children

- Surviving spouses

- Children born to or placed for adoption with a subscriber

- QB cannot be covered by or eligible to be covered by another private group health insurance plan or Medicare

- Continuous coverage requirement:

- Employee/Dependent must have been on the plan for three continuous months prior to the qualifying event.

- Maximum coverage duration:

- Nine months (versus 18-36-29 months on Federal COBRA)

- Qualifying events:

- Death of a covered employee

- Termination (other than by reason of gross misconduct) or reduction of hours of the covered employee’s employment

- Divorce or legal separation of the covered employee from an eligible dependent

- Medicare eligibility

- A dependent child ceasing to be a dependent child under the requirements of the plan

- Certain situations where the employer files for bankruptcy

- COBRA election period:

- 30 days (versus 60 days on Federal COBRA)

- Covered benefit plans:

- Medical and HRA

- No dental or vision unless bundled with medical benefits

- No standalone dental or vision

Please contact your dedicated BMS COBRA analyst with any questions you may have related to your mini-COBRA administration.

— ISSUE 20a —

The dust around the 2021 American Rescue Plan (ARP) has finally begun to settle, and second-chance COBRA offers have been mailed to assistance-eligible individuals (AEIs)! UPMC Benefit Management Services (BMS) has been sending out updated COBRA offers with language that reflects ARP regulations for qualifying events through Sept. 2021.

Let’s look at the subsidy, how it will be reported to you for payment, and how you can obtain the necessary forms related to the quarterly tax credits associated with this subsidized premium payment.

Because you are a federal COBRA client, you are responsible for paying your AEI subsidized premiums. The federal government will credit you for these payments with a quarterly tax credit. However, you will have to report these premiums to your tax department to ensure the credit is reported to the IRS accurately. For more information about the reduction in deposits for the tax credits, see Notice 2021-24 (see page 7).

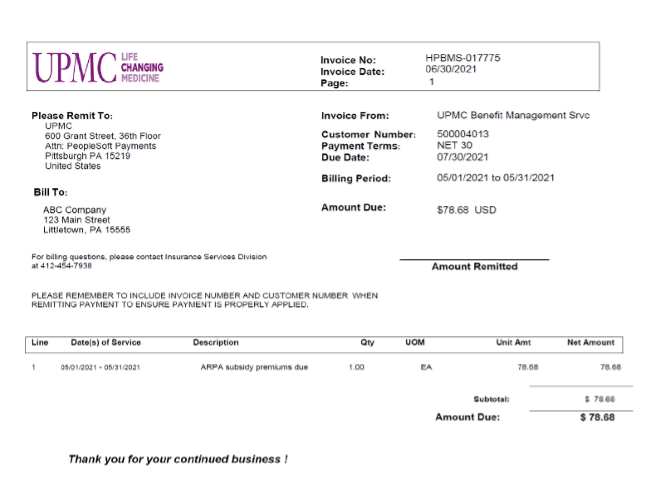

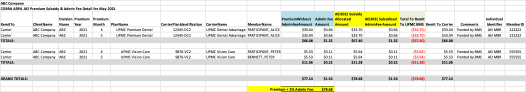

BMS is committed to reporting your subsidized premiums accurately to ensure your records are correct. As such, we will provide monthly premium remittance reports. If you have AEIs participating in your COBRA coverage, you will receive separate invoices and backups associated with the subsidy.

Please note:

- The invoices reflect the AEI subsidy premiums fronted by BMS.

- The backup reports detail the participants, plans, premiums, and administration fees.

- Your tax department should use the backups for quarterly tax reporting purposes.

Here is an example of an ARP subsidy premium invoice :

The invoice will include a backup that ties to the ARP subsidy to be “funded” by the employer. Here’s an excerpt from a backup:

As always, contact your BMS COBRA analyst with any questions related to AEIs, the subsidy, and the payments you may have.

— ISSUE 19 —

COVID-19 COBRA UPDATE

DOL Issues New Guidance on Extension of Time Frames

On May 4, 2020, the Department of Labor (DOL), Internal Revenue Service, and Department of the Treasury issued the EBSA Disaster Relief Notice 2020-01 and Joint Notice, which provided an extension of certain time frames affecting a participant’s right to health care coverage and continuation of group health plan coverage under COBRA.

These extensions were effective March 1, 2020, and were to be extended until 60 days after the declared end date of the COVID-19 National Emergency (also referred to as the “Outbreak Period”); however, under section 518 of ERISA and section 7508A(b) of the code, the extension period is limited by statute to a period of one year from the date the individual action would have otherwise been required.

As Feb. 28, 2021, marks one year of the National Emergency, the DOL issued new guidance on Feb. 26, 2021, to clarify the duration of the relief provided under the original EBSA Disaster Relief Notice 2020-01 and Joint Notice. According to this guidance, eligible individuals should be granted an extension to applicable time frames until the earlier of (a) one year from the date they were first eligible for relief or (b) the end of the Outbreak Period. On the applicable date, the time frames for individuals with periods that were previously disregarded will resume. In no case will a disregarded period exceed one year.

What does this mean for your COBRA participants?

COBRA election period:

Under normal circumstances, a COBRA qualified beneficiary (QB) has 60 days to elect COBRA.

Per the newly released guidance, a COBRA QB will have up to a maximum period of one year to make an election of COBRA. The extension deadline will be determined on a per participant basis.

Example:If a COBRA QB would have been required to make a COBRA election by March 1, 2020 (normal 60-day deadline date), the Joint Notice delays that requirement until Feb. 28, 2021, which is the earlier of one year from March 1, 2020, or the end of the Outbreak Period (the National Emergency remains ongoing).

Similarly, if a COBRA QB would have been required to make a COBRA election by March 1, 2021 (normal 60-day deadline date), the Joint Notice delays that election requirement until the earlier of one year from that date (i.e., March 1, 2022) or the end of the Outbreak Period.

NOTE: An election of COBRA must be made for coverage to be activated. If a completed election form is not received, coverage will not be reinstated.

COBRA premium payment period:

Under normal circumstances, a COBRA QB has 45 days after submitting their COBRA election to remit their initial premium due. Subsequent premium payments are due on the first of the month of coverage, with a 30-day grace period.

Per the newly released guidance, a COBRA QB will have up to a maximum period of one year to submit premium payment in full for any past due premiums. The extension deadline will be determined on a per participant basis.

Example:A COBRA QB stopped making premium payments and is paid in full through Feb. 28, 2020. The COBRA QB owes monthly premiums for March 2020 – current. Normally, premium payment for March 2020 would have been due by March 31, 2020 (normal 30-day grace period). The Joint Notice delays that requirement until March 31, 2021, which is the earlier of one year from March 31, 2020, or the end of the Outbreak Period (which remains ongoing).

Similarly, if a COBRA QB would have been required to submit payment for March 2021 premium by March 31, 2021 (normal 30-day deadline date), the Joint Notice delays that requirement until the earlier of one year from that date (i.e., March 31, 2022) or the end of the Outbreak Period.

A COBRA QB is not required to make all past due payments if the QB only needs the coverage through a certain date; however, there can be no gap in coverage. Meaning, if a COBRA QB only submits enough payment to cover two months of premiums owed, the payment will be applied in chronological order, beginning from the earliest month owed. Using the example above, payment would be applied to March 2020 and April 2020 premiums, resulting in a final COBRA coverage termination date of April 30, 2020.

Enrollment and claims

Throughout the National Emergency, UPMC Benefit Management Services has not terminated any COBRA QBs’ coverage with the insurance carrier(s) for nonpayment of premiums. COBRA QBs’ benefits have remained active, and claims have been paid accordingly.

Now that premium payment deadlines are back in place, we will resume reporting nonpayment terminations of COBRA coverage benefits to the insurance carriers accordingly.

Using the example above, if a COBRA QB owes retro premiums for March 2020 – current, the QB has until March 31, 2021, to submit payment. If payment is not received by March 31, 2021, we will report a termination of COBRA benefits to the insurance carrier(s), retro effective to the last paid-thru date (in this example, the term date would be Feb. 28, 2021). Any associated claims will be reversed and will be the COBRA QB’s responsibility.

Alternative options

The Biden administration has made available a new Special Enrollment Period because of the COVID-19 public health emergency for 2021. Individuals can enroll in Marketplace health coverage between Feb. 15 and Aug. 15, 2021. State exchanges as well as the Federal Marketplace have information pertaining to this enrollment period on their websites.

— ISSUE 18 —

Let’s have a functionality refresher: Automated COBRA qualifying event notifications available for Employer OnLine users with all lines of coverage offered by UPMC Health Plan

This feature eliminates the need for you to enter COBRA qualifying events into two separate systems: Employer OnLine (EOL) and COBRAPoint. Opting into this feature means that you will no longer have to enter the event into COBRAPoint nor complete a spreadsheet with the information to be sent to your dedicated analyst. Simply enter the information into EOL and leave the rest up to us!

Review of requirements:

- Must have all lines of COBRA-eligible benefits with UPMC Health Plan (medical, dental, vision, and FSA)

- Must utilize the EOL portal for submission of your qualifying events (QE)

If you have any questions or would like to sign-up for this functionality, our team of dedicated COBRA analysts will be more than happy to assist you. Feel free to contact your dedicated account analyst at any time. You can also send an email to our general inquiry line at COBRA@upmc.edu.

New UPMC Health Plan Benefit Management Services (BMS) COBRA clients had the option to sign up for this functionality EOL during the plan set-up process. Below is an excerpt of the set-up document referencing this functionality:

- Do you currently utilize the UPMC Employer Online portal (EOL) to submit your employees’ termination of benefits?

-

If so, do you wish to utilize the automated Qualifying Event

Notification process, where your QEs will be reported from

EOL to BMS?

If “Yes”, proceed to question 3. -

If you answered NO to question 1a., which method from the

options below will be used to notify UPMC BMS of COBRA

Qualifying Events?

- Client keys data into COBRA system via Employer Portal

- Client uploads data via file into COBRA system via Employer Portal

- Client sends notification to dedicated BMS Analyst (via Word doc or Excel file template, via Secure email or fax)

- Client sends a regularly scheduled .csv file in the specified format via SFTP (recommended for larger-volume clients)

- Do you want to us to enable the online election functionality available on our participant website? Qualified Beneficiaries will have the opportunity to elect any combination of plans offered as well as downgrade level of coverage.

Should you choose options b or d, your dedicated BMS analyst will provide the file format specifications.

UPMC BMS relies upon the information provided by you through the above-described Qualifying Event (“QE”) notification methods to perform certain COBRA Administrative services, including but not limited to the issuance of continuation of coverage election notices. As such, it is your responsibility to confirm the accuracy of all QE Notification files prior to their submission to UPMC BMS.

If you did not sign up at the time of your COBRA set-up, it’s not too late! Please contact your dedicated COBRA account analyst.

If you would like to learn more about this functionality, you can watch our recorded presentation.

— ISSUE 17 —

Did you know that UPMC Benefit Management Services offers a variety of services to meet your benefit administrative needs?

In addition to COBRA and retiree billing, we also offer a robust suite of spending accounts!

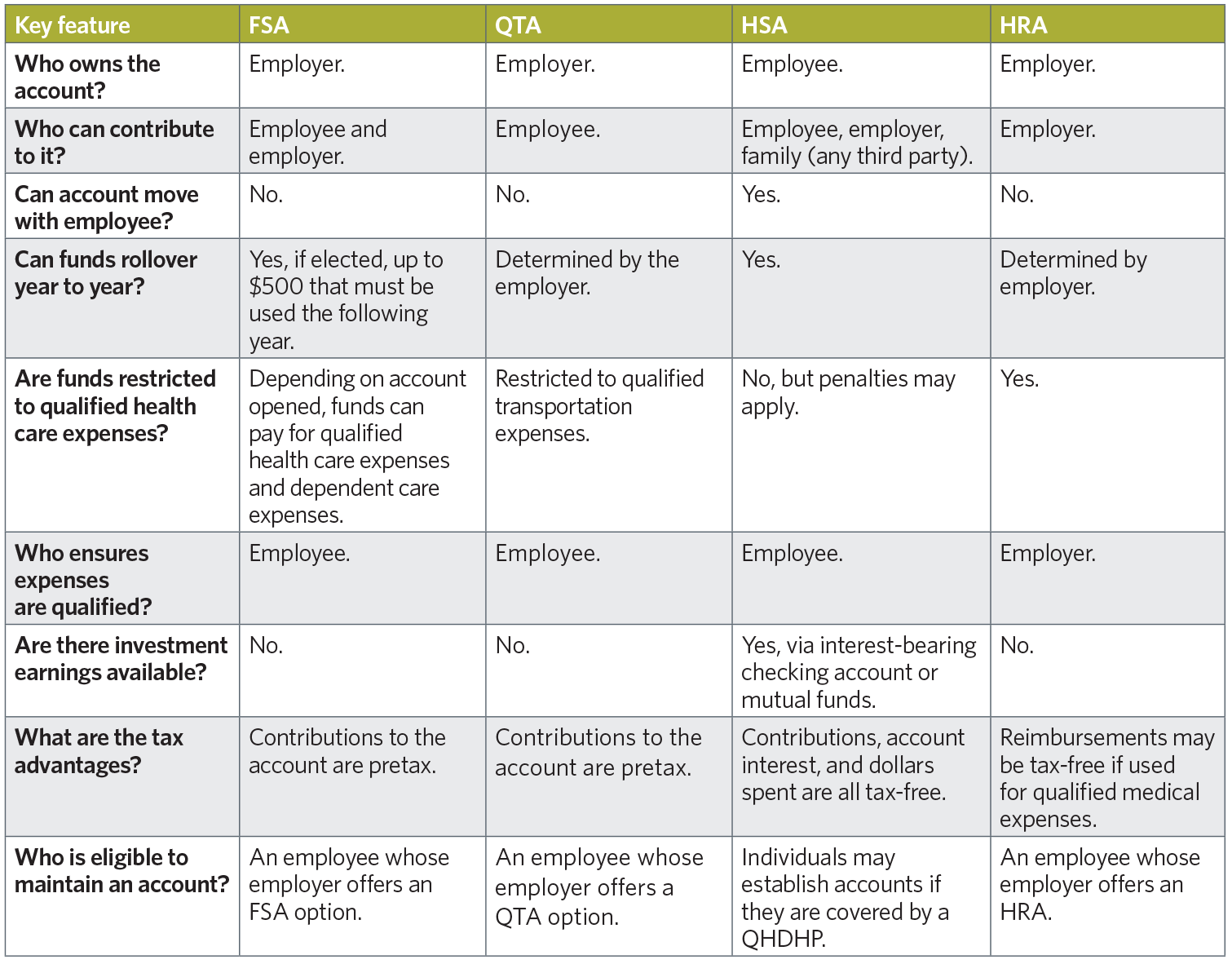

Which UPMC Consumer Advantage spending account(s) is right for your organization?

Offering spending accounts to your employees can be an effective way to help contain health costs for both your business and your employees.

With the UPMC Consumer Advantage spending account portfolio, groups of all sizes have many options. The chart below will help you compare the different spending account options available to your organization:

| Key Feature | FSA | QTA | HSA | HRA |

|---|---|---|---|---|

| Who owns the account? | Employer | Employer | Employee | Employer |

| Who can contribute to it? | Employee and employer | Employee | Employee, employer, family (any third party) | Employer |

| Can account move with employee? | No | No | Yes | No |

| Can funds roll over year to year? | Yes, if elected, up to $550 that must be used the following year | Determined by the employer | Yes | Determined by employer |

| Are funds restricted to qualified health care expenses? | Depending on account opened, funds can pay for qualified health care expenses and dependent care expenses | Restricted to qualified transportation expenses | No, but penalties may apply | Yes |

| Who ensures expenses are qualified? | Employee | Employee | Employee | Employer |

| Are there investment earnings available? | No | No | Yes, via interest-bearing checking account or mutual funds | No |

| What are the tax advantages? | Contributions to the account are pretax. | Contributions to the account are pretax. | Contributions, account interest, and dollars spent are all tax-free. | Reimbursements may be tax-free if used for qualified medical expenses. |

| Who is eligible to maintain an account? | An employee whose employer offers an FSA option | An employee whose employer offers a QTA option | Individuals may establish accounts if they are covered by a QHDHP | An employee whose employer offers an HRA |

All of the spending accounts come with a variety of user-friendly and smart-benefit perks:

- Stacked account Visa debit card

- Electronic enrollment via UPMC Health Plan

- Claim submission/processing

- Monthly participation/contribution reports

- Member/Employer website

- Dedicated Member Services team

- Member mobile app

Did someone say limits? The IRS has recently announced that the health care FSA maximum contribution for 2021 will remain at $2,750 and the transportation (or sometimes known as commuter benefit) monthly maximum will remain the same at $270.

Some other important notes on FSA limits:

- FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

- The $2,750 limit for 2021 applies on a per FSA account basis. If you have an FSA and switch jobs midyear, regardless of claims incurred, you can elect the full $2,750 in an FSA at your new employer.

- The FSA limit is the same for those participating in the health plan as single as it is for those participating as family.

- If two spouses each have access to their own FSA through their own employer, they could each elect the maximum of $2,750 for a combined household set-aside of $5,500.

- The FSA limit does not include rollovers. If an employer offers a rollover of up to $550, someone could have an FSA with $3,300 in it next year.

- Limits apply only to pretax employee contributions. Employers may contribute to an FSA in excess of the employee contribution max of $2,750.

- The $550 FSA rollover limit for 2020-2021 was increased by $50 earlier this year in a notice from the IRS.

2021 health savings account (HSA) contribution limits

announced by the IRS:

$3,600 for an individual and $7,200 for family.

Interested in adding a UPMC Consumer Advantage spending account option or have questions about your existing spending account offerings?

Your UPMC Health Plan account manager can discuss ways to incorporate these spending accounts into your company’s benefit options that suit your employees’ needs.

— ISSUE 16 —

Plan-year renewals affect COBRA participants too!

What you need to know

As you approach your Open Enrollment period, it’s important to remember that COBRA-qualified beneficiaries have the same rights as active employees. During Open Enrollment, employees are given the option to change their benefits, as well as add or remove dependents. COBRA regulations provide that qualified beneficiaries may change their coverage at Open Enrollment to the same extent as similarly situated active employees.

If you are offering an Open Enrollment period to your active employees, you must offer those same Open Enrollment options to your COBRA participants. Here’s a look at the information and options that should be made available to them:

Review of plan options

Open Enrollment materials should be provided to each COBRA-qualified beneficiary and should include the following information:

- How long the Open Enrollment period lasts (including the deadline to submit requested changes)

- The plans available (medical, dental, and vision, as applicable)

- Rates for the upcoming plan year

- Steps the qualified beneficiary will need to take to renew and/or change coverage (such as completing and returning an Open Enrollment form)

- The contact information of the employer and/or COBRA administrator

Option to change plans

During Open Enrollment, qualified beneficiaries must be given the same options as similarly situated active employees, including adding new plans and changing from one plan to another. For example, if an employer offers medical and dental coverage under two separate health plans and a COBRA-qualified beneficiary initially elected medical only for his or her COBRA coverage, he or she must be given the opportunity to add dental to his coverage during the plan’s Open Enrollment period.

Option to add dependents

During Open Enrollment, COBRA-qualified beneficiaries must be given the option to add dependents to their coverage. If, for example, a COBRA-qualified beneficiary elected and paid for Individual Only COBRA coverage at the time of the qualifying event, he or she must be allowed to add family members to his or her COBRA coverage under the plan during Open Enrollment period (to the same extent that a similarly situated active employee can do so).

Don’t forget about coupons!

Once the Open Enrollment period has ended and all updates have been made, it’s important to send new premium payment coupons with the new monthly rates to your COBRA participants. If you use UPMC Benefit Management Services as your COBRA administrator, this service is standard.

We hope that you find these tips helpful as you approach your Open Enrollment period. We know that Open Enrollment is a busy time of year. Processing Open Enrollment is time consuming and requires a lot of effort and diligence. With everything that needs to be done—from updating rates to creating and mailing materials, receiving and tracking Open Enrollment forms and answering questions—we’re here to help. Our COBRA Administration service can alleviate some of the burden by handling your COBRA Open Enrollment process for you (if you have the buy up service).

If you have any questions, please get in touch with your dedicated COBRA analyst. If you’re not sure who your dedicated COBRA analyst is, please contact us at cobra@upmc.edu for further assistance.

Go Green

So many of us receive communications electronically these days, so why not get COBRA and other billing notifications via email as well?

UPMC Benefit Management Services offers a “Go Green” option that can ease the burden of mailing documents. Check out Issue 14 under the Archive tab to read the original article.

There are many benefits of using electronic delivery:

- Reduced use of paper

- Improved delivery and receipt of notices by avoiding undeliverable letters or lost mail

- Increased security with no incorrect or double stuffing of letters or theft from mailboxes

- Faster delivery time as participants can view notices immediately

Participants selecting this communication preference will receive an email alerting them when new notifications are sent to their COBRA participant account. The following communications will be available via email:

- COBRA enrollment confirmation notices

- Retiree/Direct bill enrollment confirmation notices

- COBRA premium coupon books and notices

- Retiree/Direct bill premium coupon books and notices

- 45-day notices (with or without payment)

Please contact your assigned COBRA analyst to activate the Go Green function or if you have any additional questions.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your solicitor or tax adviser.

— ISSUE 15 —

Introducing Automated COBRA Qualifying Event Notifications

At UPMC Benefit Management Services, our goal is to take the burden of COBRA administration off your hands. We do this by offering simple, streamlined COBRA administration services. We continuously look for ways to improve our processes and efficiency, which is why we value the feedback that you provide.

We are very excited to announce a new enhancement to our COBRA administration services:

Automated Qualifying Event Notifications for Employer OnLine Users

What is it?

When submitting a termination of coverage via the UPMC Employer OnLine (EOL) website, in addition to the termination reason and coverage end date, you can now also enter the date of the qualifying event. This will allow the EOL website to communicate COBRA qualifying events to the BMS COBRA team.

How does it work?

The EOL website generates an automated report of all COBRA qualifying events submitted the prior business day. This report is delivered daily to the BMS COBRA team, who will then process the corresponding required COBRA election notices.

How does this help me?

This new feature will eliminate the need for you to key your COBRA qualifying events into two separate systems (EOL and COBRAPoint). You will no longer have to key the event a second time into COBRAPoint or complete a spreadsheet with the information to be sent to your dedicated analyst. Simply key the information into UPMC Employer OnLine and leave the rest up to us!

How do I sign up?

In order to be eligible for this service, you must have all lines of COBRA-eligible benefits with UPMC (i.e., medical, dental, vision, FSA), and you must also utilize the EOL website for submission of your qualifying events.

The client workshop on September 2 reviewed the features of this functionality and other COBRA Employer OnLine review topics. If you weren’t in attendance and want to learn more, please take time to review by watching the recorded workshop.

If you have any questions or would like to sign up for this functionality, our team of dedicated COBRA analysts will be more than happy to assist you. Feel free to contact your dedicated account analyst at any time, or the COBRA department in general, by sending an email to COBRA@upmc.edu.

Disclaimer: The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

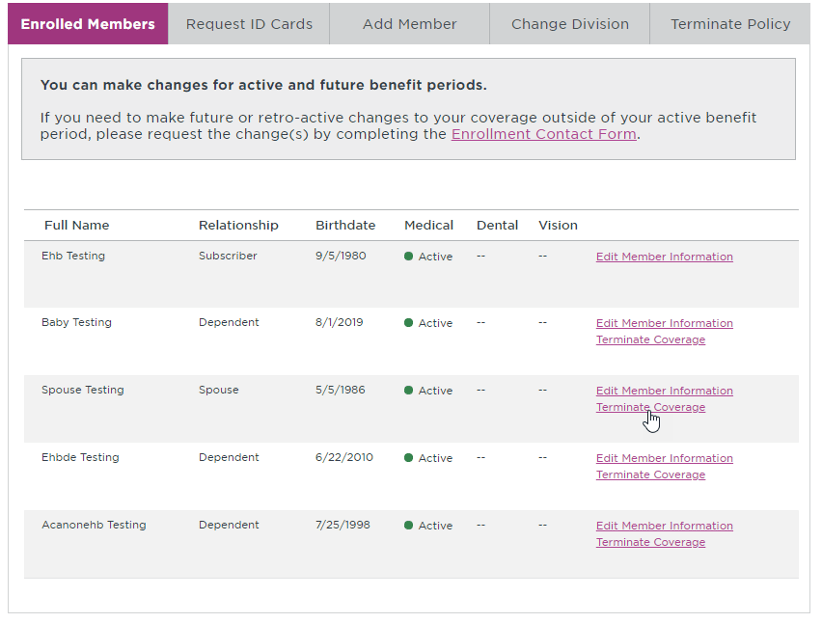

Terminate a dependent:

Terminate policy (terminates subscriber, spouse, and all dependents covered on contract):

— ISSUE 14 —

UPMC Benefit Management Services is going “green”

So many of us receive communications electronically these days, right? So why not get COBRA and other billing notifications via email as well instead of relying on “snail mail”?

The benefits of electronic communication are many:

- Reduced use of paper

- Improved delivery and receipt of notices by avoiding undeliverable letters or lost mail

- Increased security with no incorrect or double stuffing of letters or theft from a mailbox

- Faster delivery time as participants can view notices immediately online

We are promoting the paperless option to participants with this message in their paper notice:

Participants can now select email as their communication preference by visiting the participant website.

There’s another important benefit to going paperless—participants visit their website more, letting them see their payment history, upcoming payment due, coverages, and the link to online bill pay. That makes it a one-stop site for their COBRA/retiree billing needs.

Participants selecting this communication preference will receive an email alerting them of a notification to view on their participant website. The following communications will be available via email:

- COBRA enrollment confirmation notice

- Retiree/Direct bill enrollment confirmation notice

- COBRA premium coupon book and notice

- Retiree/Direct bill premium coupon book and notice

- 45-day notice (with or without payment)

Note that participants must keep their email address updated. If an email notification fails, a paper notice will be generated, ensuring participants always receive timely COBRA notifications.

To help your participants go green, contact your COBRA analyst to get started. Our service account is cobra@upmc.edu.

— ISSUE 13 —

COBRA administration

Disability extensions and second qualifying

events

People frequently ask whether they can extend their COBRA continuation coverage. The answer is yes—in two specific circumstances for a person entitled to an 18-month maximum period of COBRA continuation coverage:

- One of the qualified beneficiaries is disabled.

- A second qualifying event occurs.

Disability extensions

If any of the qualified beneficiaries in a family are disabled and meet the requirements below, all qualified beneficiaries who are receiving continuation coverage because of a single qualifying event are entitled to an 11-month extension of their continuation coverage (for a total maximum period of 29 months of continuation coverage).

The requirements are:

- The Social Security Administration (SSA) determines that the qualified beneficiary is disabled before the 60th day of continuation coverage.

- The disability continues during the rest of the initial 18-month period of continuation coverage.

In addition, the disabled qualified beneficiary (or someone on their behalf) must also notify the COBRA plan administrator of the SSA disability determination. To provide notice, a copy of the SSA Disability Award Letter must be provided to the COBRA plan administrator. The plan can set a time limit for providing this notice, but it cannot be shorter than 60 days, starting from the latest of:

- The date SSA issues the disability determination.

- The date the qualifying event occurs.

- The date the qualified beneficiary loses (or would lose) coverage under the plan as a result of the qualifying event.

- The date the qualified beneficiary is informed of the responsibility to notify the plan administrator and the process for doing so. (The qualified beneficiary may be informed of this responsibility via the plan’s SPD or the COBRA General Notice.)

If the qualified beneficiary meets all requirements, then the 11-month extension will be approved. The plan can charge the qualified beneficiary an increased premium, up to 150 percent of the cost of coverage, during the 11-month disability extension. In such cases, the COBRA administrator would retain the standard 2 percent COBRA fee, and the additional 48 percent would be remitted back to the employer.

The right to the 11-month disability extension can be terminated if SSA determines that the qualified beneficiary is no longer disabled.

Second qualifying events

If a qualified beneficiary receiving an 18-month maximum period of continuation coverage experiences a second qualifying event, they may be entitled to an additional 18-month extension of their coverage continuation (for a total of 36 months of continuation coverage, counted from the original first day of COBRA). These are second qualifying events:

- Death of the covered employee

- Divorce or legal separation of the covered employee and spouse

- Medicare entitlement

- Loss of dependent child status under the plan

The event can be a second qualifying event only if it would have caused the qualified beneficiary to lose coverage under the plan in the absence of the first qualifying event.

The plan must have procedures for how a qualified beneficiary should provide notice of a second qualifying event, and these procedures should be described in the plan’s SPD. Again, the plan can set a time limit for providing this notice, but it cannot be shorter than 60 days from the latest of:

- The date on which the qualifying event occurs.

- The date on which the qualified beneficiary loses (or would lose) coverage under the plan as a result of the qualifying event.

- The date the qualified beneficiary is informed of the responsibility to notify the plan administrator and the process for doing so. (The qualified beneficiary may be informed of this responsibility via the plan’s SPD or the COBRA General Notice.)

Of course, both extensions are still subject to early termination of coverage continuation. The plan may terminate continuation coverage earlier than the end of the maximum period for any of the following reasons:

- Premiums are not paid in full on a timely basis.

- The employer ceases to maintain any group health plan.

- A qualified beneficiary begins coverage under another group health plan after electing continuation coverage.

- A qualified beneficiary becomes entitled to Medicare benefits after electing continuation coverage.

- A qualified beneficiary engages in fraud or other conduct that would justify terminating coverage of a similarly situated participant or beneficiary not receiving continuation coverage.

If continuation coverage is terminated early, the plan administrator must provide the qualified beneficiary with an early termination notice.

If you have any questions, our team of dedicated COBRA analysts will be more than happy to assist you. Feel free to contact your dedicated account analyst at any time, or the COBRA Department in general at COBRA@upmc.edu.

Reporting on reports

A menu of standard spending account reports is available to employers. Each report has helpful information that provides insight to your company’s spending accounts. Standard reports are available on the UPMC Consumer Advantage employer portal, and additional reports can be added to your report menu on a schedule or can be emailed by request.

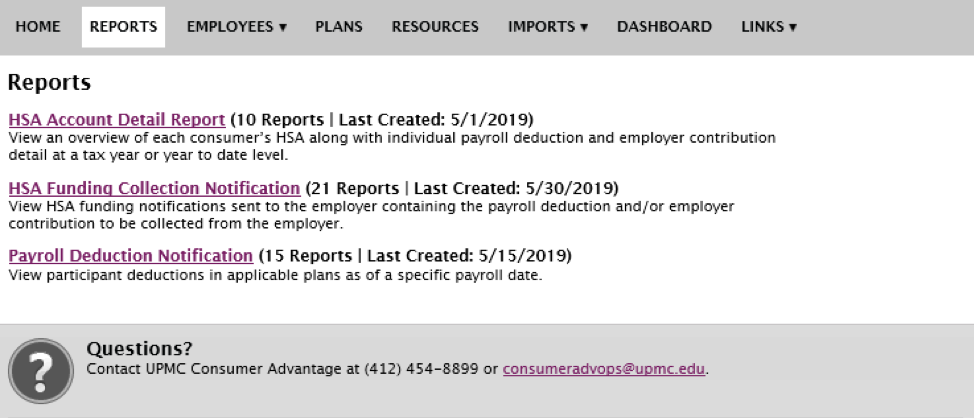

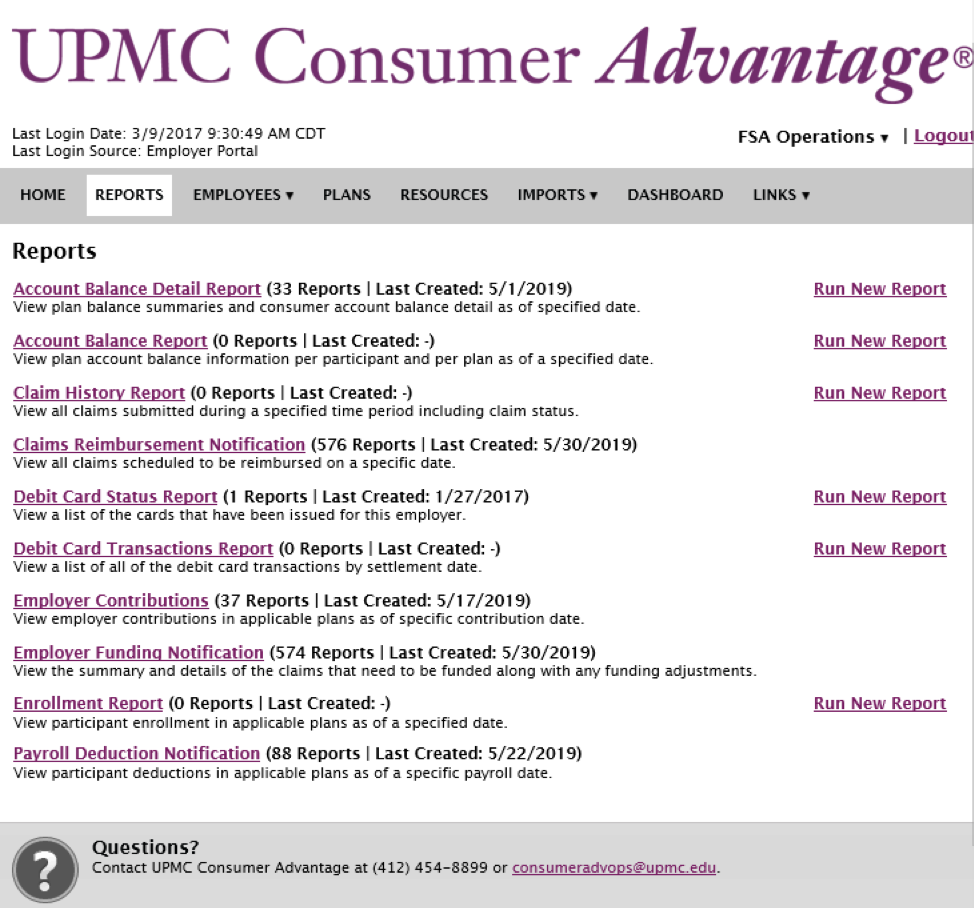

Let’s take a look at the available reports, starting with health savings accounts specific reports. Here is a typical Reports tab on the employer portal:

NOTE: The reference of consumer in the definitions above means “employee.”

Here are additional reports by request:

Blocked IDV:View a list of employee’s accounts that are blocked due to IDV.

Pending Accounts: View a list of employees who have not yet fully activated their accounts by logging in and accepting Ts and Cs.

Now let’s look at the available flexible spending (notional account) employer reports:

A few notes on the above report menu:

- This is a full menu of reports available on your employer portal.

- You may not see all of them available to you on your employer portal.

- The standard reports made available are the top four listed reports.

- The rest can be set up for you on a schedule or just made available for you to run when needed.

- Notice that the reports that do NOT have a Run New Report link on the right-hand column are system generated on a schedule.

- If you do not make an employer contribution to your employee’s FSA, the Employer Funding Notification will not be necessary. Instead, the Payroll Deduction Notification report is very useful for tracking against your actual company payroll deductions.

The above information is for informational purposes only and is not legal or tax advice. UPMC Health Plan and UPMC Benefit Management Services do not provide legal or tax advice. For legal or tax advice, please contact your attorney or tax adviser.

— ISSUE 12 —

COBRA Administration — Back to Basics

Whether you are new to COBRA administration or a seasoned professional, a review of the basics can be beneficial. In this newsletter we’ll review the standard requirements of COBRA, including what actions need to be taken, when, and by whom.

COBRA Basics

Q: What is COBRA?

A: Consolidated Omnibus Budget Reconciliation Act (COBRA) Passed by Congress in April 1986, COBRA is a law that requires employers with 20 or more employees to provide temporary continuation of coverage in certain situations when coverage would otherwise be terminated.

Q: Who is entitled to COBRA continuation coverage?

A: There are three basic requirements that must be met for an individual to be entitled to elect COBRA continuation coverage:

- The individual's group health plan must be subject to COBRA

- A qualifying event must occur.

- The individual must be a qualified beneficiary for that event.

Q: What is a qualifying event?